Safeguard against Metal Market Fluctuation

Hedging serves as an effective strategy for managing the risks associated with metal price fluctuations. By engaging in forward pricing and locking in prices, businesses can safeguard themselves against potential downward movements in metal prices. This proactive approach allows for the securement of favourable prices for metals, providing protection and mitigating the impact of further price drops.

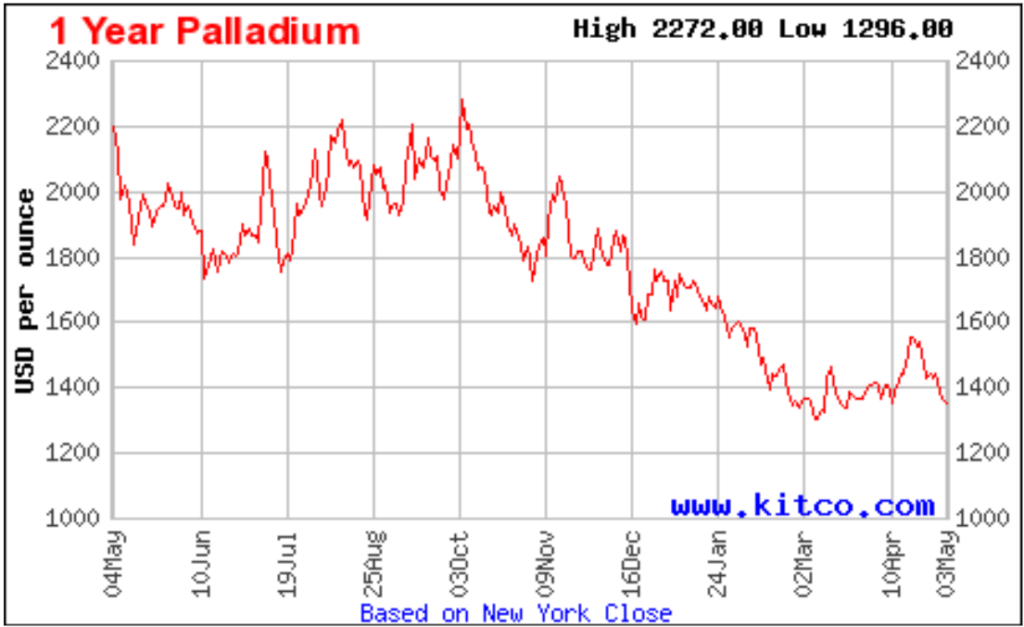

Image from www.kitco.com

To conduct business effectively, it’s crucial to assess the total availability of funds. Ideally, available cash flow should be divided among multiple shipments, allocating it into three parts. This division can be based on the time required for purchasing the first converter until the entire value of the lot can be sold upon final assay and settlement.

For example, let’s assume completing purchases takes 20 days, processing and transportation to the destination require 20 days, and an additional 20 days are needed to sell and realise the value of the lot. By organising purchase cycles into three groups, businesses can maintain a continuous buying process without interruptions.

Each shipment can be assigned an estimated value. When commencing purchasing, it’s advisable to consider hedging the lot once confidence is gained in acquiring its presumed monetary value based on the initial valuation. Implementing an effective purchasing strategy enables businesses to achieve a predetermined profit margin that is not susceptible to metal price fluctuations.

It’s important to factor in the costs associated with hedging. Financial partners may or may not offer financial instruments for hedging, and there might be restrictions based on timing, such as hedging only upon BL (Bill of Lading) or other specific criteria.

Forward pricing also incurs certain costs, including lease costs and lease days. Lease rates typically range between 3% and 12% per annum, depending on market conditions and the type of metal being hedged, among other factors.

However, since exposure usually spans only 2-4 months, the cost is significantly lower than the annual lease costs. For instance, a 90-day lease at an 8% lease rate results in an effective price difference of approximately 2%. Promptly hedging metals upon purchases is advisable to limit exposure in inventory, especially considering potential price drops in a downward-trending market.

While some people choose not to fix prices on an upward price trajectory, it’s important to note that a sudden price drop can easily wipe out profits from multiple shipments. Based on our experience, we have observed that some buyers halt their purchases and hold inventory, hoping for a price recovery. To avoid finding yourself in a similar predicament, we, at Skrya, strongly recommend continuing to hedge your purchases to ensure predictable profits and sustain your business in the long term.

An alternative perspective worth considering is focusing on cost reduction and efficiency improvement. In addition to managing risks associated with declining metal prices, identifying opportunities for cost reduction and efficiency improvement is crucial. This approach can enhance profitability and help counterbalance losses resulting from market volatility. SKRYA can assist in securing favourable prices when you lock in those hedges. Now might be an opportune time to review both metal price fixation and logistics, as they can impact lease days.

Different buyers offer different metal prices when fixing metals. A prudent move might be to find out how much premium they can offer over publicly available bid prices. Skrya strives to provide premiums above market prices based on your volume. Your bottom line can be impacted by even a slight difference here.

Staying informed about the metal market is vital. Stay updated on price fluctuations and market developments by following news and market updates, and utilise tools like price charts and technical analysis.

Catalopedia provides hourly price updates and insights through notifications. Additionally, we offer price alerts, as we receive updates from the trading desk. This is usually far ahead of publicly available price indicators. Our mobile application offers free access to price charts and updates, along with notifications for urgent and critical market information.

If your shipments weigh at least 500 kg or more, and you are interested in settlement on an assay basis while protecting against price fluctuations to secure the best deal, please reach out to us or email us at support@catalopedia.io.

Like, share, and follow us for more informative articles.

Disclaimer: This blog is solely for informational purposes. These opinions and views are not representative of the people or organisations discussed. All information posted to this blog and any links provided are not guaranteed to be accurate or effective, and we will not be held liable for any errors in this information. There is no intention to offend any individual, brand, or institution with this blog.